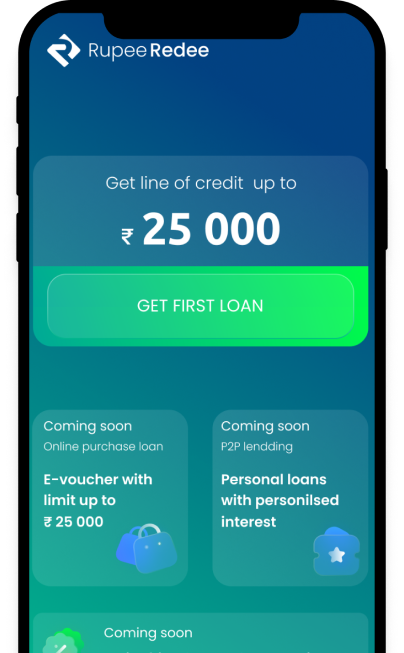

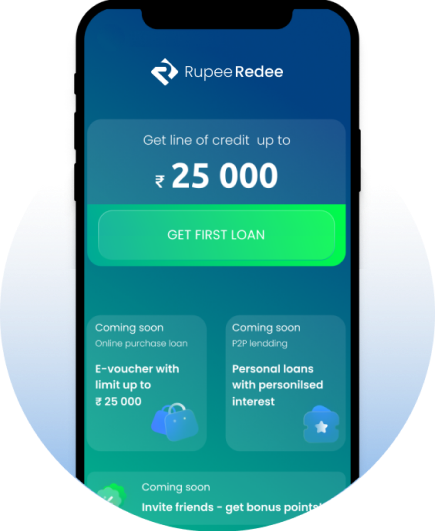

Simple financial solution

Instant personal loans

at your fingertips

Loan amount up to ₹ 25,000

Tenure up to 6 months

Clicking on the 'Get started' button will confirm that you have read and agree to the above Terms and conditions and Privacy Policy. This site is protected by reCAPTCHA and applies to the Google Privacy Policy and Terms of Service.

RupeeRedee is partnered with its Lending Partner Fincfriends Private Limited (an NBFC registered with RBI)